Good evening everyone! Hope you all had a nice and relaxing weekend after a pretty volatile week in the markets! First thing I saw as I woke up this morning was that Crypto was on a tear with some main coins up 30%+ in just 24 hours. A lot of this can be attributed to POTUS’s announcement about the US’s intentions of a crypto reserve, (Stay tuned for the watchlist that will include a name we may piggyback on this crypto run!) Obviously we had a lot to deal with last week as far politics and geopolitics creating quite a large range in our indexes. We will be looking into the charts to see where we may be headed next as well as the major zones I will be watching on SPY 0.00%↑ coming into the week ahead.

Trade Recap of the Week

This week I want to highlight a trade we took on Friday in the room. I also shared this trade on X for my followers. This was a SPY 0.00%↑ call trade to close out the week. Lets take a look at the chart and what I was seeing to trigger our entries

I was sharing with the room that the gold line resistance was lining up closely with the recent short term downtrend. I love when this happens because when two resistance levels align and we get a breakthrough of them The resulting moves are likely swift and violent.

We played this move via the 588C for 0DTE. which went parabolic from our .77 entry sky rocketing upwards of 6.50 by the closing bell. We closed just over 594 after topping out at 594.72 late in the day which was just a stone’s throw from a target I threw out early on Friday morning that initially seemed like a joke

Chaz’s Watchlist

I’m gonna start this week with DIA 0.00%↑ strictly looking at the hourly chart which has created a solid base between 430-440. I’m looking for this name over 439 to get into and fill our gap to the upside at 442+ with a weekly target off 448

I will be looking at near the money calls for Friday on this one.

Next up for me this week is AAPL 0.00%↑ which has a little C&H look on the hourly with a gap overhead to fill.

I like this name long over 242 via the weekly 245C and my target around 247 and the initial gap starts in the mid 244s

Third up for me this week is TSLA 0.00%↑ which has been taking a beating and a lot of people are curious about if the bottom is in. in this name. I’m not here to speculate on whether or not it is I am here to look at the chart and share my views. We have created a nice shelf below 300 here with buyers rejecting lower prices multiple times this past week. That said we are not out of the weeds yet. My plan on this name is to start a position as long as we hold the 293 level This position will likely be 310/315C for the week with my Add levels on a break of 303 to target 326.

Last up for me this week is COIN 0.00%↑ (This is the name I look to play to piggy back off the Crypto surge we saw today. This name will likely be gapping up quite a bit so its tough to say the strike I will be looking at but I do think This name can get some legs this week. My initial level for entry is 221 with my targets at 253 and 277. This name is volatile and that shows in the options premium, I will be looking for some pretty far OTM calls in this name and playing smaller size do to premium risk I’ll be looking likely at the 250C (Unless we somehow gap over that level.

That’s it for me this week guys! Ive had a choppy couple weeks but finally got my heels into the dirt late last week as far as playing the SPY 0.00%↑ range. Looking forward to the week ahead! Let’s make it a great one!

-Chaz

If you’d like to join us live in real time where Ben and I share our thoughts and charts live as the day is unfolding along with when we have something on watch and our live entries, stops and targets consider joining us in the room for Less than $3 a day, Its like this newsletter but Live every single day! https://www.launchpass.com/the-altitude-life/lp-membership

From Ben: $SPX closed a volatile week slightly lower overall but well off the Friday bottom after a month end surge saw prices higher into the close and reclaiming the 5950 level after filling the open gap down near 5850 and testing the anchored VWAP from the August low which coincided with that price zone. We did leave some 1min and 5min gaps below us to 5919 so may see a bit of a back fill early in the week. Friday was likely a short term low at that key gap fill point with a lot of momentum stocks fairly washed out and due for a snapback. We are already seeing $BTC bouncing in a risk on signal. SPX quickly corrected off that new high just the prior week and now has potential seasonal tailwinds working for a bounce to continue into early March that sees first resistance at the 8 EMA near 5975 while 6000 is then stiff gamma resistance that would be a clear line in sand to get above for stability to increase and see VIX contract back down. Overall the markets are simply rangebound on a longer timeframe for the past 3 months moving between 5800 and 6100 and a decisive break of that range would likely bring with it the next 200-300 point move. The 200 day EMA is down at 5700 and would be a clear target on a downside break of 5850 but with sentiment historically low in some measures and it still being a bull market an upside move is still more likely than not as long as implied volatility retreats. We will talk about those indicators later as normal. For $SPX this week we retest that trendline break from early Jan. There are a few AVWAPs above of note as well but the biggest one likely now the ATH AVWAP near 6000. Lots of confluence at that level. We are still below the 8D as well so keep your head on a swivel.

$SPX levels for the week: 5842/5873/5890/5910/5935/5950/5972/5992/6000/6007/6024/6036/6045

Sentiment/Indicators: AAII sentiment for the week ending 2/26 showed bullish responses drop to 19.4% from 29.2% prior while bearish responses jumped to 60.6% from 40.5%. (MARK THIS as this is a wash out in sentiment). Neutral sentiment fell to 20.0% from 30.3%. Bullish sentiment was last lower on March 16, 2023, (19.2%) and was among the lowest 65 readings in the survey’s history. The bull-bear spread (bullish minus bearish sentiment) decreased 30.0 percentage points to –41.2%. The NAAIM Exposure index fell to 87.87 from 91.48 last week and is just above last quarter’s Q4 average of 85.81. Friday’s close saw NYSE new highs at 61, while new lows of 143 and the 10-day MA of New High/Low Differential is negative at -15. The percentage of SPX stocks above their 50-MA is 55.2% while those above 200-MA was 60.0%. NYMO McClellan Oscillator closed at -8 and is Neutral. The cumulative AD line bounced off the 40 EMA short term breadth trend and is still above the 89 EMA long term bull signal. CBOE Equity P/C 50-day MA is at 0.56. CNN Fear and Greed index is in Extreme Fear zone at 20 from 35 last week. The VIX/VXV ratio closed at 0.97 after hitting 1.0 on Thursday. This measures the spread between 1- and 3-month implied volatility, above 1.0 shows fear and can mark a low another in the cap of a short term low.

$NYSI remains in bear mode and RSI has fallen to 50. So clearly not out of the woods so bounce may not last long but this is an area to watch for a possible turn into March OPEX.

Earnings Calendar: AVGO 0.00%↑ MRVL 0.00%↑ CRWD 0.00%↑ TGT 0.00%↑ some big ones.

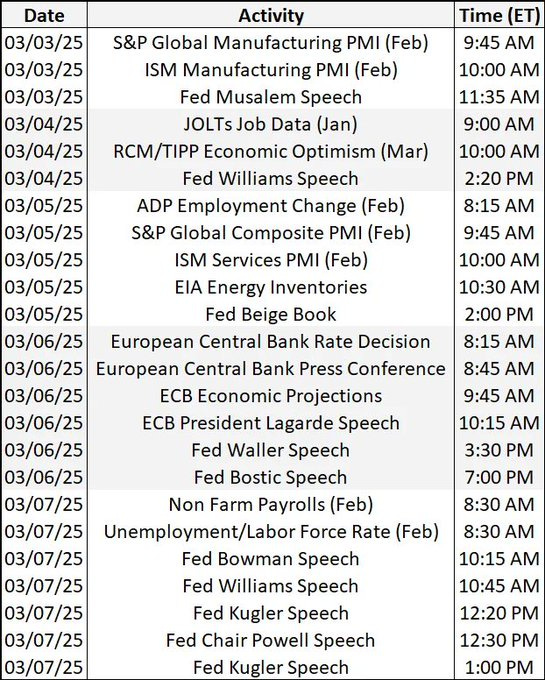

Economic Calendar:

Watchlist for the week: AMZN 0.00%↑ BERY 0.00%↑ NDAQ 0.00%↑

AMZN 0.00%↑ Stoch and RSI hitting some lows here with a tag of trendline possible double bounce off this trendline.

Buyable level: 210.50

Targets: 216/219/222

BERY 0.00%↑ is set up well here in an uptrend with a flag at POC here. Div. is this week and would likely be a good AM buy point there.

Breakout: 72.70

Targets: 75.50/77/78.30

NDAQ 0.00%↑ another that has showed some real strength lately and has a great ER candle. Sitting near ATHs here.

Breakout: 83.05

Targets: 87.30/92.40

If you’d like to join us live in real time where Ben and I share our thoughts and charts live as the day is unfolding along with when we have something on watch and our live entries, stops and targets consider joining us in the room for Less than $3 a day, Its like this newsletter but Live every single day! https://www.launchpass.com/the-altitude-life/lp-membership