Good evening everyone and Happy Sunday! Hope you have all been enjoying your weekends. Was another busy week for me as the wife and I finally got back home to Vegas and got unpacked in the brisk 100 degree weather. For all of you returning readers I hope you managed to extract some money out of the markets last week because of Issue #44! Last week’s newsletter was a solid foundation to start the week from the SPY 0.00%↑ thoughts to the watchlist with the team and I taking 2 out of the 3 watchlist names for 105% and 90% respectively. Before I get into what I’m looking at for the upcoming week lets breakdown a coupe of last week’s newsletter plays!

Last Week’s Recap

First let’s take a look at my plan for ast week.

The plan was to wait for demand or supply and move forward from there.

Now that we can see those levels on last weeks c hart let’s see how the week unfolded.

We opened monday morning within the expected range before quickly falling into the demand zonne outlined from 584-586. We saw buyers step in to defend the zone ultimately closing higher and right near my pivot level outlined. From there we headed straight to supply at 592/593 after one consolidation candle there buyers proved acceptance over supply pushing us ultimately to BOTH of my UPSIDE Targets laid out last week 596/599. Absolutely perfect price reaction to the levels and zones which allowed us to take advantage of multiple $SPY trades this week.

Moving on from SPY 0.00%↑ let’s take a look at the watchlist trades. I liked CCL 0.00%↑ and SNOW 0.00%↑ for the week. Both names hit my triggers on Monday morning so we started the swings.

Both of these trades worked out great with both names reaching targets Allowing us to scale out for 105% and 90% gains.

Not a bad week for the Newsletter readers if you ask me!

Ready to do it again this week?!

Let’s dive in!

SPY 0.00%↑ Attack Plan

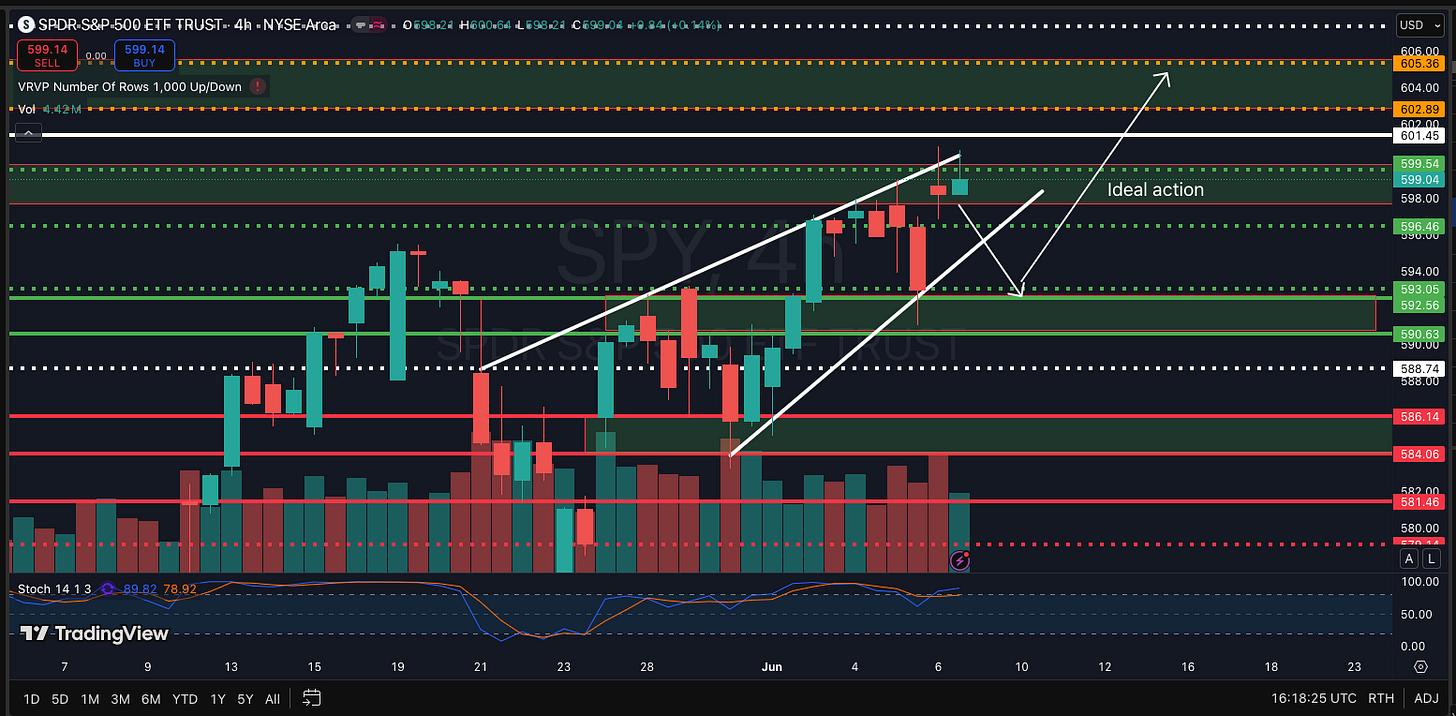

Last week SPY 0.00%↑ closed up 1.6% on the week bringing us to +2.5% YTD. Last week we explored the outlined demand early in the week and never looked back driving us straight to the round number 600 price. Friday we slowed down a bit as far as movement after a decent gap up buyers had trouble at the 600 mark ultimately closing the week out at 599.14.

I have 600 as a previous zone on the chart here.

Pivot Zone: 598-600

Demand: 590-592

Supply: 602-605

Upside Targets: 602.89/605.36/607.36

Downside Targets: 593/590.63/588.74

I believe the 600 spot is gonna be tough to crack, I won’t be looking long unless we see buyers step in and we get acceptance on the hourly over 600.

My preferred action would be a retest of 593 before heading higher and ultimately toward 605

Chaz’s Watchlist

First up this week is TSLA 0.00%↑ which obviously got hammered last week after the girl’s got into on twitter. The 290-300 price zone is a very large level for this stock with it acting as resistance for 2 + months until finally breaking out mid May, we have now returned to this zone. I will be watching for buyers to step in and hold this zone to get a resistance turned support flip. I’ll be looking for acceptance over 300 to target 318/330

I’ll be looking at weekly 315C in this name.

One thing I find interesting about TSLA 0.00%↑ as well is this month is it’s best seasonality month and we already starting this month -14% A bounce here makes a lot of sense!

Next up this week is PYPL 0.00%↑ which has a great setup on the daily chart. This however is a slower mover so I will be looking at buying a little more time in this name (Probably 3-4 weeks out.)

We have a decent looking IHS formed and closed the week over the neckline.

I’ll be looking at the 75 strike in this name towards the end of June/ beginning of July.

Last up for me this week is AMZN 0.00%↑ which closed the week out over resistance with a nice hammer on the daily.

I’ll be looking at the weekly 215C in this name to target 218.50. I’d prefer a slight retest early in the week this week toward 211-212 and hold to get long.

That’s it for me this week guys we have a lot of momentum from last week so let’s keep it going!!!! Happy Sunday and enjoy the rest of your weekends!

-Chaz